A vast number of Veterans have not yet received these benefits and discounts. Most are missing out simply because they don’t know what to do. Here's a list of top benefits and special offers that could put several thousands dollars back into your pocket this year. Get them right now before it's too late.

Please note: While most of these benefits apply to veterans, non-veterans may still check their eligibility. It is worthwhile for all Americans to see how much money they can save by using this free list!

Still unknown to many homeowners is an amazing new way to borrow called the HELOC Plan (Home Equity Line of Credit) that could benefit millions of Americans and give them up to hundreds of thousands of dollars without refinancing! Many are seizing this opportunity, but chances are most homeowners don't even know about it.

The average Homeowner doesn’t realize how much untapped, readily accessible credit is sitting in their homes! With property values still at historic highs, home equity lines of credit (HELOCs) are becoming a popular way to access significant funds - sometimes up to hundreds of thousands of dollars!

Whether it’s for home improvements, paying down high-interest debt, starting a business, or even planning a big family trip, a HELOC gives you flexible access to the equity you’ve already built. It’s a smart financial tool that more and more homeowners are exploring in today’s economic environment.

There’s no cost to check if you qualify, and it only takes about 60 seconds to answer a few quick questions. With interest rates and market conditions in flux, it’s a great time to take action!

The 2026 VA Cost-of-Living Adjustment (COLA) is a 2.8% increase, effective December 1, 2025, with the first higher payment received on December 31, 2025, boosting monthly disability, DIC, and other benefits to help with inflation. This automatic adjustment applies to most VA benefits, increasing payments based on your disability rating, with no action needed from most veterans to receive it.

Enter ZIP to Check Eligibility Here

Many veterans are unaware of the huge auto insurance discounts that are available to them. If you’re over the age of 25 and you're paying more than $39/month for car insurance, there’s a good chance you’re missing out on these discounts. Click below to check if you're eligible for full coverage insurance for as low as $39/month.

Tap Here to Check Eligibility

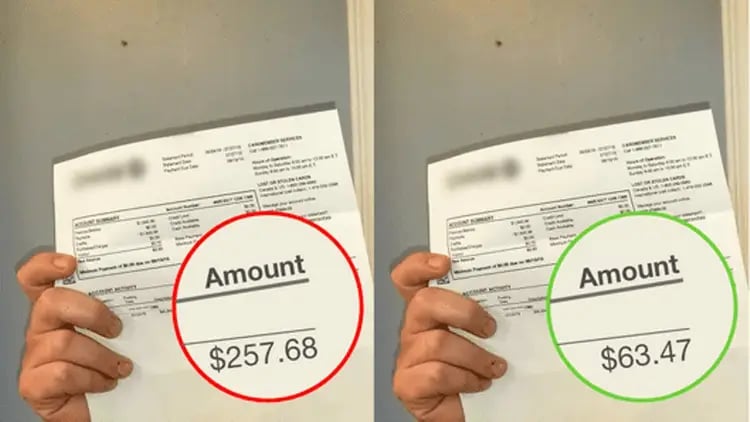

Credit card companies won't tell you this, but they can't stop you either...

This newly approved Debt Forgiveness Program is helping millions of Americans to rid themselves of credit card debt. Settle over $25,000 of your debts without taking out more loans! The banks and credit card companies won't be too happy about losing their big profits from high interest rates, and might hope that people don't find out about this program. Note: this program is available only to those who owe large amounts of money to credit card companies. The current minimum balance to be approved is $25,000. If you owe $25,000 or more in credit card debt, and currently have a source of income tap below to see if you qualify.

Still unknown to many homeowners is a brilliant new website being dubbed as "The Amazon of Home insurance" that could benefit millions of Americans and reduce their monthly payments significantly every year! You could bet the home insurance companies aren't too thrilled about losing all that profit and might secretly hope homeowners don't figure out how to use this site. Tap below to view your savings now.

Tap Here to Check Eligibility

A little-known benefit from the Interior Department gives military veterans with any disability rating from the Department of Veterans Affairs a free lifetime pass to national parks and other recreation areas, as well as discounts on some fees.

The lifetime Access Pass is advertised as available to those who “have been medically determined to have a permanent disability … does not have to be a 100 percent disability.” - A National Parks official confirmed that any veteran with a disability rating from the VA should be able to access it.

This new website is helping homeowners get new windows this year.

Imagine never having to pay full price for windows again! Thanks to this new site, you can get the highest rated and insured vendors in your area to compete for your business and secure the lowest possible price without sacrificing quality.

You may be able to save thousands on new windows by shopping around for the best quote - which could lead to huge savings.

If you meet these 3 requirements, you may be eligible for huge savings:

• Own a home

• Windows are over 6 years old

• Live in a qualified zip code

Still unknown to many is a brilliant government backed mortgage program called the FHA Cash-Out Plan that could allow homeowners to access up to $185,000 in cash to use however they'd like! You could bet the banks aren't too thrilled about this and might secretly hope homeowners don't find out before this program ends for good. American homeowners are paying for their home renovations, paying off debts , funding their business, and even taking vacations - All thanks to the government's home "cash out" option that is now available. Home values are through the roof right now and smart homeowners are taking advantage of their huge equity in their house and getting up to $185,000 back! It is 100% FREE to see if you qualify.

So while the banks happily wait for this program to end, experts are making a nationwide push and urging homeowners to take advantage. This program currently exists, but with national economic uncertainty, it is possible that this won't last very long. But the good news is that once you're approved, you're in. If getting up to $185,000 to use however you'd like sounds good, it's vital you act now and see if you could qualify for the FHA Cash-Out Plan now.

HOW TO CHECK IF YOU'RE ELIGIBLE

● Step 1: Click the button below

● Step 2: Answer a few questions (it takes just 60 seconds)

Veterans should never have to pay full price for roof repairs again. A bad roof can lead to all sorts of problems - mold, animal infestation, damage, and other expensive situations that can be easily avoided through proper maintenance.

It's easy to keep putting off replacing a home's roof, especially given the historically high cost of doing so.

Now thanks to this brilliant new website, expensive roof repairs are a thing of the past! In fact, homeowners that use this new site will never have to pay full price again. Every homeowner should check and see how affordable getting a new roof can really be.

If you have an IRA, 401(k), or other type of retirement account, request your FREE Retirement Loophole Guide now. Use this simple tax loophole to efficiently and easily diversify your retirement portfolio. Bonus: Qualify for $15,000 in FREE Silver! Those age 55+ with $20,000 or more saved towards retirement could qualify.

A Veteran ID Card (VIC) is a digital form of photo ID you can use to get discounts offered to Veterans at many restaurants, hotels, stores, and other businesses. As of September 2022, all new Veteran ID Cards are digital. If you already have a physical Veteran ID Card, you can continue using it to get discounts.

1. This Free Service Helps Homeowners Replace Old Windows

2. Debt Relief Program Helps to Reduce $12,000+ Debt

3. Drivers Are Getting a $712 Savings

4. Veterans Get $1,200 Home Insurance Savings

© 2026 veteransavingslist.org. All Rights Reserved.

*Average savings of $3,250 per year (270 per month) from http://www.freddiemac.com/finance/pdf/RefiReport2013Q3.pdf

**homeowners who refinance from 30 year fixed mortgages to 15 year fixed mortgages can save up to $145,000. Further information: www.nytimes.com/2011/08/21/realestate/exploring-the-15-year-loan-for-refinancing-mortgages.html.

*Figures are an average of the HELOC range Based on 2026 Experian Report https://www.experian.com/blogs/ask-experian/research/home-equity-line-of-credit-study/

¹Loan uses may be restricted by lender covenants. Terms & Conditions apply.

seniorsavingssurvey.com is not a mortgage broker or lender, seniorsavingssurvey.com acts as an independent advertising publisher. This webpage is formatted as an advertorial and is brought to you by seniorsavingssurvey.com. An advertorial, is an advertisement that is written in an editorial news format. PLEASE BE AWARE THAT THIS IS AN ADVERTISEMENT AND NOT AN ACTUAL NEWS ARTICLE, BLOG, OR CONSUMER PROTECTION UPDATE. seniorsavingssurvey.com MAY RECEIVE PAID COMPENSATION FOR CLICKS OR SALES PRODUCED FROM THE CONTENT FOUND ON THIS WEBPAGE. seniorsavingssurvey.com does not use your financial information to apply for a mortgage, refinance, or other loan. Any provided information made to us, shall be passed on to our third party advertising partners.

Copyright 2026 veteransavingslist.org

Privacy Policy

Terms Of Use